The numbers are in! Thursday afternoon, Amazon finally released their sales figures for the first three months of 2012. And the stock market was absolutely thrilled by Amazon’s newest numbers, sending the price of Amazon’s stock up on Friday by more than 16%! This means that overnight, the portfolio of Amazon CEO Jeff Bezos increased by nearly $2.5 billion, and the value of Amazon’s shares increased by more than $10 billion!

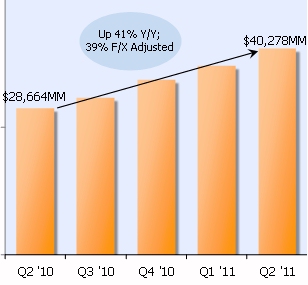

Why was Wall Street so excited? After all, it turns out that Amazon increased its operating cash flow, but only by $20 million. (Unfortunately, their “free cash flow” actually dropped by $750 million — though it’s still at a hefty $1.15 billion.) But the big question was whether or not Amazon sold more books than they had the year before — and the answer is yes! In fact, Amazon’s net sales increased by a whopping 34%, to $13.18 billion, for the first three months of 2012. (Last year, Amazon only sold $9.86 billion worth of products during the same period…) Amazon’s gross margins experienced “the largest uptick in 10 years,” according to one stock analyst.

Just in North America, Amazon sales were $7.43 billion — more than 36% more than they were at the same time last year. Still, due to the higher expenses, Amazon’s total net income also dropped quite a bit, down $71 million (to just $130 million) for the first three months of 2012. But even professional stock-pickers were impressed, with at least 11 different firms raising their price-point for buying Amazon’s stock. And Amazon also announced some other very interesting statistics on Thursday.

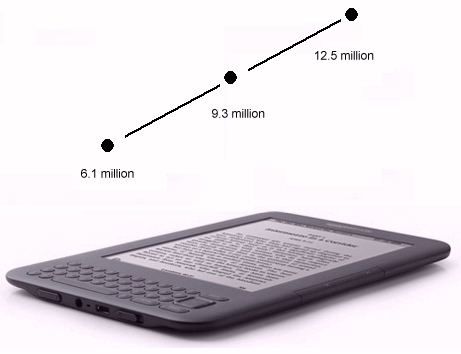

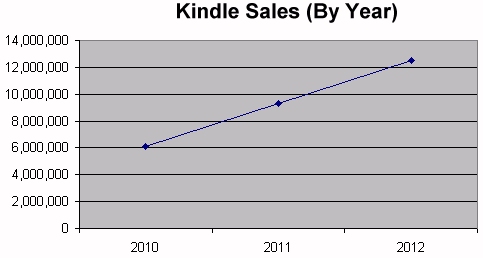

Their Kindle Fire tablet is now the #1 best-selling item in the Kindle Store — and the #1 most-gifted item in the store! And while Amazon’s not saying how many ebooks, movies, and songs have been downloaded, they did acknowlege that in the first three months of 2012, “Nine out of ten of the top sellers on Amazon.com were digital products – Kindle, Kindle books, movies, music and apps.” Deep in their press release, Amazon also revealed that “worldwide media” sales grew 19% (compared to the first three months of last year), now representing sales of $4.71 billion. (The Christian Science Monitor noted that’s “more than twice as fast as the 8 percent year-over-year gain posted in the quarter through December.”) And “electronics and other general merchandise” sales grew 43%, to $7.97 billion.

It looks Amazon’s already starting to see a fantastic pay-off from the big bet they’d placed on Kindle Fire touchscreen tablets!